Can I Retire Now? How Sequence of Returns Affects the Answer

In a previous article, Can I Retire Now, I shared the 4 Percent Rule which holds that retirees can withdraw 4% from their investment portfolios each year and never run out of money. If you’ve read the article, you now know that sometimes retirees can safely withdraw more than 4% each year and sometimes less than 4%, depending upon their circumstances and the returns in the market.

One factor that matters quite a bit is the sequence of returns that you experience in retirement and in particular, what happens early on in your retirement.

3 Unrealistic But Informative Examples

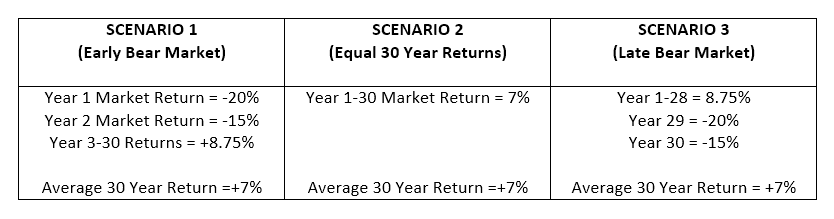

Let’s look at 3 different sets of market returns. None of these would occur exactly as written but they illustrate the importance of sequence risk for those nearing retirement. Let’s say you’re 70 years old and ready to retire. You want to know you’ll have enough money to live on through age 100, which would represent a 30 year retirement period. The following table below shows the 3 sample scenarios:

You may have noticed that even though each scenario has different returns in individual years, they all average out to be the same 7% return across the entire period. You then may be tempted to think that retirees experiencing any one of these returns would be in pretty much the same shape in terms of what they can withdraw.

Doing the Math

For each of these scenarios, let’s make the following assumptions:

- You have $1 million in retirement savings.

- You start off with a 4% withdrawal from your nest egg in year 1 or $40,000.

- You want to increase your annual withdrawals to keep up with inflation of 3% per year.

When we crank through the numbers, here is what each retiree will have left over at age 100:

Scenario #1 – Final Balance = -$99,049 (the money runs out at age 99.)

Scenario #2 – Final Balance = $2,064,313

Scenario #3 – Final Balance = $2,768,393

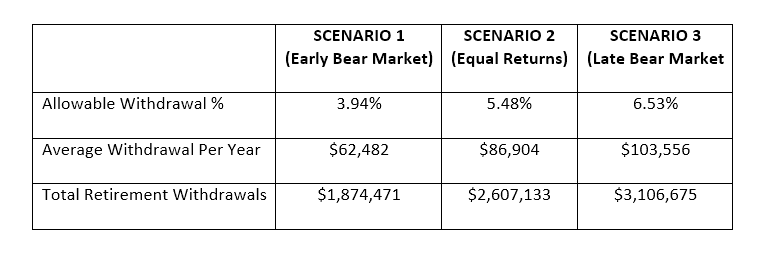

We can also change our assumed withdrawal rate and calculate both the maximum annual percentage withdrawal without running out of money and the total amount of money that can be withdrawn for the 30 year retirement period:

Wow – what a huge difference between Scenario 1 & Scenario 3! While both sets of retirees experienced identical 7% average investment returns throughout retirement, those that got hit with an early bear market were only able to take out an average of $62,482 per year compared to the $103,556 for those that experienced a late bear market.

Wow – what a huge difference between Scenario 1 & Scenario 3! While both sets of retirees experienced identical 7% average investment returns throughout retirement, those that got hit with an early bear market were only able to take out an average of $62,482 per year compared to the $103,556 for those that experienced a late bear market.

Do I Need to Worry About This?

So a natural question to ask to see if you should be worried about this is “How Often Do Bear Markets Occur?” From 1929-2013, we have had one every 3.5 years or so. In the post-WWII period, they have been somewhat less frequent and have happened about once every 5 years.

Regardless of what time period you’re using, it’s been awhile since we’ve had a bear market. The last one was 7 years ago lasting 17 months from October 2007 through March 2009 and hammered the market with a 54% loss over that period.

Here’s What Not to Do

No one knows when the next bear market will occur. It could be this year, it could be five years from now, we simply don’t know. Resist the urge to yank all of your money out of the market and park it in CD’s making little or no interest. Remember, in all of the scenarios above, retirees needed to be earning an average of 7% a year to keep up with inflation and keep making steady withdrawals from their nest eggs.

So What Can You Do?

With my clients nearing retirement or in the early stages of retirement, I recommend the following:

Stay Diversified –

Be sure your portfolio contains a healthy dose of bonds, international stocks, commodities and real estate. These assets can help steady your returns during periods of declines in US equity markets.

S-L-O-W-L-Y Trim Stock Holdings –

If you planned on entering your retirement years with 60% of your portfolio invested in stocks, consider trimming this by 5-10% or so. If we make it out of 2016 without a major correction, trim your stock holdings a further 5% or 10% each year until the inevitable bear market occurs. Then once the market bottoms, boost your holdings back to your original targets.

I like setting myself up for these kinds of win-win scenarios with investing. If a bear market occurs in the next year or two, I feel like I’ve won because I’ve protected at least a portion of my portfolio. And if the bear doesn’t pay us a visit for another 3 or 4 years, I also feel like I’ve won because I’ve still maintained a decent exposure to stocks.

Be Open to Changing Your Plans –

If we do experience a bear market in the near term, be prepared to defer retirement for a year or two to build a bigger nest egg. Or, if you’ve recently entered retirement, consider pursuing an encore career or trimming down on expenses for a little while until the financial storm passes.

While markets never stay good forever or bad forever, you ALWAYS have options to create a wonderful retirement for yourself that you can enjoy for decades to come!